same here 6 figures in the crapper should have bough a new truck. Added more last week I am a IdiotI have about 5% in LSPD. It's down a lot.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stocks

- Thread starter Boots

- Start date

Gonna ride it to the bottom now wont be adding again.So sad about lspd. It better become the next shopify

Stupid question….how does one buy precious metals?

Obviously gold is through the roof now, but there are others.

Coins?

Bars? Where to keep?

Stocks? Mines? Producers?

Obviously gold is through the roof now, but there are others.

Coins?

Bars? Where to keep?

Stocks? Mines? Producers?

I have a small stake in gold.to is one way to do it

Sent using a thumb maybe 2

Sent using a thumb maybe 2

I wouldnt buy physical metals. Id buy a security that buys metals. Physical metals have a high transaction cost and effort and storage complications. If you buy physical metal you can probably write off a safe or safe deposit box (iirc there are some rules around this but dont remember the rules exactly).Stupid question….how does one buy precious metals?

Obviously gold is through the roof now, but there are others.

Coins?

Bars? Where to keep?

Stocks? Mines? Producers?

Diversify through a precious metal m/f at your bank.Stupid question….how does one buy precious metals?

Obviously gold is through the roof now, but there are others.

Coins?

Bars? Where to keep?

Stocks? Mines? Producers?

There's precious metal etf's. I'll never buy another etf, but they are out there.

Then stock. Barrick for example.

If you're in a gambling mood, check NUGT for 2X gold percentage upswings.

I haven't looked at this site in yrs, but you could buy physical gold & other metal there.Stupid question….how does one buy precious metals?

Obviously gold is through the roof now, but there are others.

Coins?

Bars? Where to keep?

Stocks? Mines? Producers?

Live Gold Prices | Gold News And Analysis | Mining News | KITCO

KITCO Covers The Latest Gold News, Silver News, Live Gold Prices, Silver Prices, Gold Charts, Gold Rate, Mining News, ETF, FOREX, Bitcoin, Crypto, Stock Markets

Why no more ETFs?Diversify through a precious metal m/f at your bank.

There's precious metal etf's. I'll never buy another etf, but they are out there.

Then stock. Barrick for example.

If you're in a gambling mood, check NUGT for 2X gold percentage upswings.

He got burned on hou so did I it should have been perfect timing but they basically said sorry we won't pay and devalued the fund.Why no more ETFs?

Sent using a thumb maybe 2

Buy an ETF - I've got CGL.TOStupid question….how does one buy precious metals?

Obviously gold is through the roof now, but there are others.

Coins?

Bars? Where to keep?

Stocks? Mines? Producers?

iShares Gold Bullion ETF (CAD-Hedged) (CGL.TO) Stock Price, News, Quote & History - Yahoo Finance

Find the latest iShares Gold Bullion ETF (CAD-Hedged) (CGL.TO) stock quote, history, news and other vital information to help you with your stock trading and investing.

That's insane. I didn't even know that was a possibility.He got burned on hou so did I it should have been perfect timing but they basically said sorry we won't pay and devalued the fund.

Sent using a thumb maybe 2

Neither did I cost me 6 figures, leaves a bad taste for ETF fundsThat's insane. I didn't even know that was a possibility.

Sent using a thumb maybe 2

Wow....that's making me question my VGRO.TO fund. Been one of my best / consistent performers. Not perfect I'm sure.Neither did I cost me 6 figures, leaves a bad taste for ETF funds

Sent using a thumb maybe 2

Just put in an order for $1500 of VGRO and $800 of ENB for both the kids RESPs.

I like ENB simply for the steady growth / dividend. Once the money comes in from the gov't I'll add some bank stocks to them.

blackcamaro

Well-known member

HOU and VGRO aren't comparable even though they are both ETF's. HOU is a leveraged fund that is meant to be traded in and out of daily and carries significant risk that's geared towards traders not investors. It isn't a buy and hold. I don't understand it well enough to explain but if you're curious look up leveraged ETF decay.Wow....that's making me question my VGRO.TO fund. Been one of my best / consistent performers. Not perfect I'm sure.

Just put in an order for $1500 of VGRO and $800 of ENB for both the kids RESPs.

I like ENB simply for the steady growth / dividend. Once the money comes in from the gov't I'll add some bank stocks to them.

Regular index funds like VGRO don't have anywhere near the risk.

Thanks for that explanation, appreciate it. Still learning but more each time that I look into it.HOU and VGRO aren't comparable even though they are both ETF's. HOU is a leveraged fund that is meant to be traded in and out of daily and carries significant risk that's geared towards traders not investors. It isn't a buy and hold. I don't understand it well enough to explain but if you're curious look up leveraged ETF decay.

Regular index funds like VGRO don't have anywhere near the risk.

Leveraged funds at 2:1....HOU and VGRO aren't comparable even though they are both ETF's. HOU is a leveraged fund that is meant to be traded in and out of daily and carries significant risk that's geared towards traders not investors. It isn't a buy and hold. I don't understand it well enough to explain but if you're curious look up leveraged ETF decay.

Regular index funds like VGRO don't have anywhere near the risk.

If the sub index goes up 10% the fund goes up ~20% (due to the leverage). If the sub index or subset goes down 10% the fund goes down ~20%. Twice the upside and twice the downside. BTW they have bear versions that down 10% is up 20% and up 10% is down 20%.

Holding is not a huge problem if the longer term trend will be up but becomes much more risky when the fund is more focused (like oil) as it wins or loses (@2:1) on that subset. BTW recently revenge selling HOU.TO for past bad performance was not a good call for anyone holding it.... Short term of course holds less risk. They also have these funds that track S&P500, DOW, NASDAQ etc.... which will be a win if the market wins.

IMO it is not the funds fault, they track something and that something may be good or bad. The investor decides which fund. The fund does not start trading different things to mitigate risk, that is not the purpose.

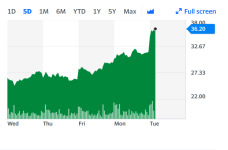

Here is an even better chart example that tracks the NASDAQ 100 (HQU) vs the NASDAQ overall.

This is one I use and I will hold for maybe days or in some cases months. I bought last year around $14 and held it all the way until late December and sold at $20. Why did I sell.... it was becoming volatile and I just did not have enough time/focus to track it daily, xmas, work, etc. (this is important when they get volatile), I could see inflation pressure and possibly Ukraine war at the time so risk was high, it was volatile I was out. It worked out to a ~30% increase for me, If I held I would be evensteven on the year today. Once I feel things are at bottom (really hard to do) I will likely go back fairly long.

If I was a genius I would have went from HQU to HQD (the bear version) and I would be up 30% in the last three months! Sadly, I am not that ballsy.

This is one I use and I will hold for maybe days or in some cases months. I bought last year around $14 and held it all the way until late December and sold at $20. Why did I sell.... it was becoming volatile and I just did not have enough time/focus to track it daily, xmas, work, etc. (this is important when they get volatile), I could see inflation pressure and possibly Ukraine war at the time so risk was high, it was volatile I was out. It worked out to a ~30% increase for me, If I held I would be evensteven on the year today. Once I feel things are at bottom (really hard to do) I will likely go back fairly long.

If I was a genius I would have went from HQU to HQD (the bear version) and I would be up 30% in the last three months! Sadly, I am not that ballsy.

Exactly what Steve said.Why no more ETFs?