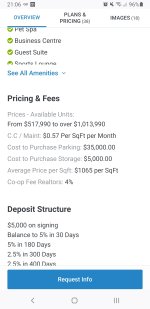

One time 35K per spot. If you are trying to buy at the cheap end (eg one bedroom) don't be surprised if they won't allow you to buy more than one spot. Underground spots cost a fortune to build and are very space inefficient in most buildings (small building footprint means a large percentage of every parking floor is a road).

EDIT:

If the plan is to use the condo to climb the property ladder, I'm not convinced that works. I'd rather buy a freehold something in a place I could afford and rent that out. Paying ~550K for 500 sq ft plus condo fees of $300+ a month (escalating quickly) makes it really hard to trade up. Hell, it makes it hard to afford today yet alone tomorrow. $300 a month would roughly service another 60K of mortgage. If the fees rise quickly they both deplete your cashflow and suppress the value of the condo as new buyers have less to spend on mortgages.

Emerald condos just more than doubled their fees.

When condo fees more than doubled in a Toronto building, it sparked a nasty dispute involving legal threats, frightening e-mails, and accusations of a conspiracy, according to a new Ontario Superior Court judgment.

toronto.ctvnews.ca

"The issue of suddenly rising condo fees is not limited to that building. An Ontario Auditor-General's report in 2020 found many developers had sold units using understated amounts for condo fees in their initial budgets — and didn't include expected expenses.

A survey in the report found about half of condo boards saw their fees go up by up to 30 per cent. Around four in 10 boards saw it increase more than that. One in 10 didn't know."