The party usually ends when the property value crashes. In his case he has a backup plan to cash in investments, many don't.Sitting with a friend last night I jokingly asked , how long will it take to pay off your two million dollar mortgage on your cottage ? His answer , who cares? My two million is earning five to seven percent and I borrowed this money at three . If it swings wrong I could pay it out . Or sell the place and take my property value gains . Why would I use my own money if I didn’t have to? I guess that’s why he has a three million dollar cottage and I do not lol.

@shanekingsly , that’s a great info list , a lot of people take what appears the best deal not looking at the fine points .

Sent from my iPhone using GTAMotorcycle.com

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mortgage rates

- Thread starter ToSlow

- Start date

My mortgage is also up in November. Going from 2.04% to who knows what, but definitely higher

Going to look at paying weekly so more goes towards principal than interest. Right now we're doing biweekly.

I keep looking at "new" houses/properties, but then do the math on the higher amount and question if it's worth it. If I just live where I am forever, I'll be mortgage free by or before 50 years old.

Going to look at paying weekly so more goes towards principal than interest. Right now we're doing biweekly.

I keep looking at "new" houses/properties, but then do the math on the higher amount and question if it's worth it. If I just live where I am forever, I'll be mortgage free by or before 50 years old.

If I just live where I am forever, I'll be mortgage free by or before 50 years old.

Impressive.

That's actually ahead of schedule for most people, not just for your age group.

I was free earlier than that but missed a lot of youth stuff. It's a life balance issue.Impressive.

That's actually ahead of schedule for most people, not just for your age group.

I was free earlier than that but missed a lot of youth stuff. It's a life balance issue.

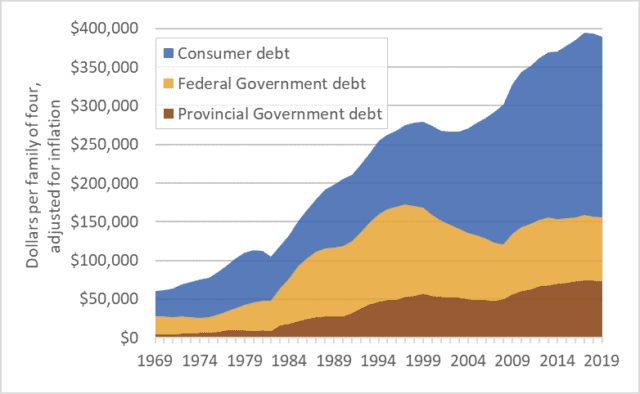

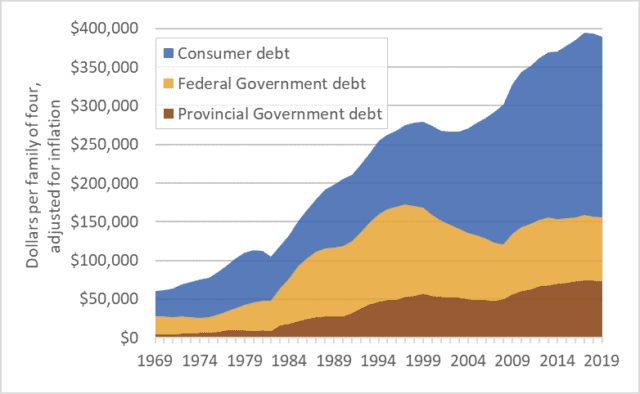

Definitely. However this chart shows that many people are skewing towards the other end of the spectrum.

Understood that we're in a period of stagnating wages and high inflation, but for many older folks, they've lived through two or three similar downturns in their lives and many have embraced austerity measures during those times instead of turning to financing to satisfy their cravings for toys, luxuries and other depreciating assets.

I know a lot of younger people in their 30s and 40s who aren't TechBros and are still able to live within their means even in this challenging environment.

yayaokayboomerandallthatnoise

If we didn't race bikes we could easily knock a couple years offImpressive.

That's actually ahead of schedule for most people, not just for your age group.

The biggest issue we have with the house is that it's a single car garage, that we've squeezed 9 bikes into. So trying to work on them is a pain as you always have to shuffle. So if we were to ever move, it'd be for more land and a bigger garage, and hopefully we have enough equity (bought pre-covid) that we could keep/afford the same term on the house. I don't want to be forced to work past 65.

To each their own.Definitely. However this chart shows that many people are skewing towards the other end of the spectrum.

Understood that we're in a period of stagnating wages and high inflation, but for many older folks, they've lived through two or three similar downturns in their lives and many have embraced austerity measures during those times instead of turning to financing to satisfy their cravings for toys, luxuries and other depreciating assets.

I know a lot of younger people in their 30s and 40s who aren't TechBros and are still able to live within their means even in this challenging environment.

yayaokayboomerandallthatnoise

Elderly neighbours from years ago had been through the depression and lived tight, day old bread etc.

He passed away. She passed away and their three kids inherited the house and whatever money there was.

One kid went to Florida for a month and another to California. The third bought a Cadillac. It was gone but somehow didn't seem right.

Some couples live day to day and are content writing monthly cheques, treading financial water and contributing equally. Then one dies and while the food cost drop in half, the rent doesn't but pensions evaporate.

To each their own.

Most definitely.

Many of my friends are spendthrifts. New motorcycle traded in every 3-6 months. Lots of toys and high-end vacations. Everything on credit.

Not what I would do, but at least they own up to their fiscal habits and don't blame immigrants/boomers/politicians for making them spend money recklessly.

Elderly neighbours from years ago had been through the depression and lived tight, day old bread etc.

He passed away. She passed away and their three kids inherited the house and whatever money there was.

One kid went to Florida for a month and another to California. The third bought a Cadillac. It was gone but somehow didn't seem right.

Yep, very common story.

The next wave of trickle-down wealth is upon us - CPA Canada

$1 Trillion in wealth transfer.

Just in Canada.

Maybe some brain math geniuses can help me out here...

How does one calculate the MINIMUM monthly interest payment on an LOC?

For instance, I take out 20k of LOC and then how would I figure out the minimum payment for interest only?

Another question...

Say I have an LOC with Prime (which I currently do), but want to track 2 separate withdrawals for tax purposes. Any recommendations?

I have a 35k LOC at Prime available, and wouldn't mind using it for some other items but if it's income generating I'd need to split out the costs for item A, from item B in order to track properly.

Haven't touched my HELOC yet, but that's because it's Prime + 1% so why bother paying extra unnecessarily?

How does one calculate the MINIMUM monthly interest payment on an LOC?

For instance, I take out 20k of LOC and then how would I figure out the minimum payment for interest only?

Another question...

Say I have an LOC with Prime (which I currently do), but want to track 2 separate withdrawals for tax purposes. Any recommendations?

I have a 35k LOC at Prime available, and wouldn't mind using it for some other items but if it's income generating I'd need to split out the costs for item A, from item B in order to track properly.

Haven't touched my HELOC yet, but that's because it's Prime + 1% so why bother paying extra unnecessarily?

Maybe some brain math geniuses can help me out here...

How does one calculate the MINIMUM monthly interest payment on an LOC?

For instance, I take out 20k of LOC and then how would I figure out the minimum payment for interest only?

Another question...

Say I have an LOC with Prime (which I currently do), but want to track 2 separate withdrawals for tax purposes. Any recommendations?

I have a 35k LOC at Prime available, and wouldn't mind using it for some other items but if it's income generating I'd need to split out the costs for item A, from item B in order to track properly.

Haven't touched my HELOC yet, but that's because it's Prime + 1% so why bother paying extra unnecessarily?

I think the monthly minimum is different for each institution.

Used to have a HELOC at CT, they never mandated a monthly minimum. Just rolled the interest back into the loan at the start of each month. As long as I didn't go over my limit, they were happy just tacking on interest every month.

I now have an unsecured LOC. They actually debit my chequing account for the monthly minimum.

Here's a monthly interest calculator from RBC:

miz_net_lpc

@Amazon , is it possible to add a lean to addition or “shed” to your single garage to increase space ?

Moving is always more expensive than anyone figures , between closing costs , land transfer tax, giving fifty K commission to my agent selling and lawyers I spent ninety grand in fees .

We were mortgage free at fifty one, selling and moving twice always moved the goal line . Last move I took a hundred k mortgage so I didn’t burn all my cash at hand but paid it out in a year . I know it’s different for everyone but I feel if being a homeowner is your thing , paying out the mortgage debt as fast as possible is a good idea . I can’t believe the people I read about retiring and paying a mortgage. I’d rather be on a plane headed for a beach thank you .

Sent from my iPhone using GTAMotorcycle.com

Moving is always more expensive than anyone figures , between closing costs , land transfer tax, giving fifty K commission to my agent selling and lawyers I spent ninety grand in fees .

We were mortgage free at fifty one, selling and moving twice always moved the goal line . Last move I took a hundred k mortgage so I didn’t burn all my cash at hand but paid it out in a year . I know it’s different for everyone but I feel if being a homeowner is your thing , paying out the mortgage debt as fast as possible is a good idea . I can’t believe the people I read about retiring and paying a mortgage. I’d rather be on a plane headed for a beach thank you .

Sent from my iPhone using GTAMotorcycle.com

The way the roof line is, we can't extend the garage either direction. We have talked about getting a bigger/more solid shed put in the back eventually. Will still cost a pretty penny as the ground is very sloped, but really the only option for where we are. And likely the route we'll take.@Amazon , is it possible to add a lean to addition or “shed” to your single garage to increase space ?

Moving is always more expensive than anyone figures , between closing costs , land transfer tax, giving fifty K commission to my agent selling and lawyers I spent ninety grand in fees .

We were mortgage free at fifty one, selling and moving twice always moved the goal line . Last move I took a hundred k mortgage so I didn’t burn all my cash at hand but paid it out in a year . I know it’s different for everyone but I feel if being a homeowner is your thing , paying out the mortgage debt as fast as possible is a good idea . I can’t believe the people I read about retiring and paying a mortgage. I’d rather be on a plane headed for a beach thank you .

Sent from my iPhone using GTAMotorcycle.com

And I agree. My coworker is 68 and we were talking yesterday about finances when she retires at 70. I mentioned paying off the mortgage to not have that expense since she only has CPP, whereas she's planning to borrow another 20k against it. She got the house for $70k about 15 years ago and my brain can't compute why it's still not paid off.

Funny I just helped a friend do a big sloped ground shed at his camp . She’d bought from the Amish/mennonite bunkie shed guys on every highway . We asked what base was required and did ten posts with wooden platform for shed. Ten inches at back and four ft posts at front , post hole guy was forty bucks a hole , platform cost about six hundred , ten twelve shed was forty four hundred.

The seventy yr old friend scares me , a seventy G house in my opinion should be paid off with a **** salary in just over fifteen yrs . What’s retirement going to look like ? Saving up two weeks for a coffee? Yikes

Sent from my iPhone using GTAMotorcycle.com

The seventy yr old friend scares me , a seventy G house in my opinion should be paid off with a **** salary in just over fifteen yrs . What’s retirement going to look like ? Saving up two weeks for a coffee? Yikes

Sent from my iPhone using GTAMotorcycle.com

At first I was like WOW nine bikes. Then I stopped and took a count. I'm at 8 (9 if you count the moped hanging from the ceiling -I don't) and a sled.The biggest issue we have with the house is that it's a single car garage, that we've squeezed 9 bikes into.

I call it garage Tetris.So trying to work on them is a pain as you always have to shuffle.

we have with the house is that it's a single car garage, that we've squeezed 9 bikes into

I'm at 8 (9 if you count the moped hanging from the ceiling -I don't) and a sled.

F-n ballers in this thread.

Money???

I'm 63 and retired 6 years ago. The Squeeze and I were frugal but managed to enjoy ourselves (there's always been more than one bike in the garage).

A buddy one year younger than me who has always made decent money (millright) and seemed to spend it stopped by not long ago. When we got talking about me being retired he asked me "what's the income stream?"

How does a relatively clever guy make it to 60 and not have a clue how he will fund his retirement?

I'm 63 and retired 6 years ago. The Squeeze and I were frugal but managed to enjoy ourselves (there's always been more than one bike in the garage).

A buddy one year younger than me who has always made decent money (millright) and seemed to spend it stopped by not long ago. When we got talking about me being retired he asked me "what's the income stream?"

How does a relatively clever guy make it to 60 and not have a clue how he will fund his retirement?

We've seen the pics. Don't even start.F-n ballers in this thread.