Inflation, stagnation, shrinkflation, what's the reality and why are our three major political parties like the three monkeys, deaf, dumb and blind?

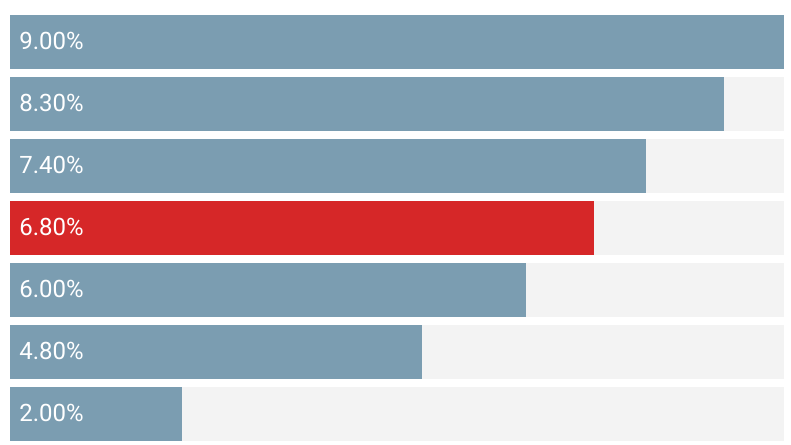

Inflation is supposedly about 7%. Seriously????

I filled the car gas tank, drove to the grocery store and bought a head of lettuce. Tomorrow I file for bankruptcy. We're not eating the romaine. We just pass it around and take turns licking it.

Stagnation: I don't hear a bunch of people bragging about double digit raises, other than Galen Weston types. We are actually being told prices will not go down and raises will not match inflation.

Shrinkflation: I keep getting frustration stares from my wife when I mention liter tubs of yogurt or ice cream. Will we some day see gas at 1.399 per half later.

Shrinkflation is a total rip off because not only does the unit cost of the product go up the shelf cost has to cover the new packaging. The spin offs include the difficulty of cost comparing and recipe adjustments. Here's where a packaging law could help. Make standard packaging numbers for mainline grocery items. We buy 5 pound bags of potatoes not 4.8 points. We buy liters of milk not 900 ml except with chocolate milk which I've seen in 900 ml cartons.

Mention any of the above to politicians and they suddenly decide to look for new stars in the constellation and begin to whistle. If they address the question they typically start with "You have to understand........" another peeve of mine.

Why, when I point out a problem, do I get told I have to understand?

Why doesn't the person creating the problem have to understand?

Inflation is supposedly about 7%. Seriously????

I filled the car gas tank, drove to the grocery store and bought a head of lettuce. Tomorrow I file for bankruptcy. We're not eating the romaine. We just pass it around and take turns licking it.

Stagnation: I don't hear a bunch of people bragging about double digit raises, other than Galen Weston types. We are actually being told prices will not go down and raises will not match inflation.

Shrinkflation: I keep getting frustration stares from my wife when I mention liter tubs of yogurt or ice cream. Will we some day see gas at 1.399 per half later.

Shrinkflation is a total rip off because not only does the unit cost of the product go up the shelf cost has to cover the new packaging. The spin offs include the difficulty of cost comparing and recipe adjustments. Here's where a packaging law could help. Make standard packaging numbers for mainline grocery items. We buy 5 pound bags of potatoes not 4.8 points. We buy liters of milk not 900 ml except with chocolate milk which I've seen in 900 ml cartons.

Mention any of the above to politicians and they suddenly decide to look for new stars in the constellation and begin to whistle. If they address the question they typically start with "You have to understand........" another peeve of mine.

Why, when I point out a problem, do I get told I have to understand?

Why doesn't the person creating the problem have to understand?