Doesn’t sound bad to meAiiiyyyeee I need to switch bikes!! I'm paying $1300 for a Daytona 675 @ 42yo on 9th year clean record

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How much do you pay for insurance?

- Thread starter CHRIS63

- Start date

Aiiiyyyeee I need to switch bikes!! I'm paying $1300 for a Daytona 675 @ 42yo on 9th year clean record

yikes!

waitin4BOOST

Well-known member

Its bad when compared to a Street Triple with identical slightly detuned motor, but half the price for insurance lolDoesn’t sound bad to me

Yes…super sports are super sports.Its bad when compared to a Street Triple with identical slightly detuned motor, but half the price for insurance lol

Sochi

Well-known member

It's been a while since I posted on this forum

Have been reading here a lot and here is the best I managed to find right now.

Male 45-50

Coming back to riding after 10 years break.

Bike: 2021 Yamaha MT-09 SP

$1220 with Intact via:

Christopher South (SurNet Insurance Group Inc.)

csouth@surnet.net

P: 416-546-8969

F: 866-491-4002

Have been reading here a lot and here is the best I managed to find right now.

Male 45-50

Coming back to riding after 10 years break.

Bike: 2021 Yamaha MT-09 SP

$1220 with Intact via:

Christopher South (SurNet Insurance Group Inc.)

csouth@surnet.net

P: 416-546-8969

F: 866-491-4002

afici0nad0

Well-known member

^

Price is very reasonable based on what i pay

Price is very reasonable based on what i pay

Got a new to me bike.

2018 Aprilia Tuono V4 1100 RR

Male

Late 30s

Single

M2

3rd season riding

Vaughan

Bundled with tenant and auto through TD. Comp and collision. $1320 per year. Note that my previous bike was an '09 CBR600rr and the premium was within $10, essentially the same.

2018 Aprilia Tuono V4 1100 RR

Male

Late 30s

Single

M2

3rd season riding

Vaughan

Bundled with tenant and auto through TD. Comp and collision. $1320 per year. Note that my previous bike was an '09 CBR600rr and the premium was within $10, essentially the same.

kurtrules

Well-known member

I switched from Echelon to TD this year. Around $250 cheaper

Just received my documents. It's actually $400 less than last year, not $250. Down from $1611 to $1211 annually.

Did you purchase any additional injury or income loss type of coverage or is that a regular premium?Just received my documents. It's actually $400 less than last year, not $250. Down from $1611 to $1211 annually.

Do you have an M or M2 as well?

You bike costs a bit more than mine and I have full M, but I also have much more than standard coverage and I pay the same price.

kurtrules

Well-known member

I have an M2 license. The insurance package is comprehensive minus the collision. Same as last year.Did you purchase any additional injury or income loss type of coverage or is that a regular premium?

Do you have an M or M2 as well?

You bike costs a bit more than mine and I have full M, but I also have much more than standard coverage and I pay the same price.

With TD, I got the ride and drive + multi line discount.

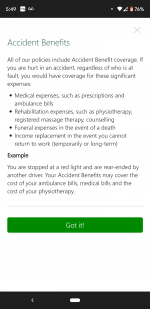

For income replacement, they have that in their accident benefits clause -

Not sure if this is what you were inferring to. I have nothing additional.

Ok. So maybe check the premium specifics of your policy. From what I know and not sure if this is current or now changed, the minimum (and standard) income loss benefits that get paid out are $400/week if you are unable to work as a result of an accident. For some people that might be ok, but for me, I decided to pay a higher premium per year (additional $240/yr which is the biggest premium increase to my policy) and it provides up to (edit: checked and it's $800/week) in income loss coverage. For me this is really helpful to ensure that bills get paid if I am unable to work for a prolonged period of time.I have an M2 license. The insurance package is comprehensive minus the collision. Same as last year.

With TD, I got the ride and drive + multi line discount.

For income replacement, they have that in their accident benefits clause -

View attachment 51119

Not sure if this is what you were inferring to. I have nothing additional.

Years ago I was hit head on and off work for a year. The income loss benefits at $400 a month were only enough because I had some savings to carry me through the year. For those that live closer to a paycheck to paycheck lifestyle and have a mortgage or rent payments in the $2k/month range, then $400/week will leave a significant deficit each month.

I also purchased additional coverage related to critical care if I should get in an accident, and these include:

Additional Catastrophic Impairment coverage increased to $2million

Non Catastrophic care increased to $130,000

Option Death and Funeral to Spouse ($50,000)

From what I understand these extra types of coverages were brought in as a result of the Wynne govt making insurance "cheaper" but in reality it seems to have just made certain things a la carte that were not previously. I'm no insurance professional, so I could be off base with any of the above.

Last edited:

Ok. So maybe check the premium specifics of your policy. From what I know and not sure if this is current or now changed, the minimum (and standard) income loss benefits that get paid out are $400/week if you are unable to work as a result of an accident. For some people that might be ok, but for me, I decided to pay a higher premium per year (additional $240/yr which is the biggest premium increase to my policy) and it provides up to $1000/week or $1200/week in income loss coverage (can't recall which). For me this is really helpful to ensure that bills get paid if I am unable to week for a prolonged period of time.

Years ago I was hit head on and off work for a year. The income loss benefits at $400 a month were only enough because I had some savings to carry me through the year. For those that live closer to a paycheck to paycheck lifestyle and have a mortgage or rent payments in the $2k/month range, then $400/week will leave a significant deficit each month.

I also purchased additional coverage related to critical care if I should get in an accident, and these include:

Additional Catastrophic Impairment coverage increased to $2million

Non Catastrophic care increased to $130,000

Option Death and Funeral to Spouse ($50,000)

From what I understand these extra types of coverages were brought in as a result of the Wynne govt making insurance "cheaper" but in reality it seems to have just made certain things a la carte that were not previously. I'm no insurance professional, so I could be off base with any of the above.

You got it Shane. And not all agents or brokers are the same about asking what you want. Many riders want the cheapest rate and end up with basic coverages and don’t realize it until an accident happens.

For the 200/300 premium to boost your income loss from 400 a week to a $1k or more is worth it for many. I’m sure there would be some wondering how to make ends meet while attempting to heal.

Sent from my iPad using Tapatalk

If no one has mentioned it to you before, then definitely check some of the brokers that are on this forum. The range of prices for premiums can really vary from one insurance company to the next and different brokers will have relationships with different insurance companies.This is useful information. Will help make an informed decision on my front. Thank you.

For me it’s no different than shopping for a mortgage. It’s not just the rate I’m looking for, but also what I’m getting within the terms of the agreement.

For whatever it’s worth, I’ve been with Surnet (contacts details in post #226 above) for about 5 years and they are excellent - I think my current policy is with Aviva.

kurtrules

Well-known member

If no one has mentioned it to you before, then definitely check some of the brokers that are on this forum. The range of prices for premiums can really vary from one insurance company to the next and different brokers will have relationships with different insurance companies.

For me it’s no different than shopping for a mortgage. It’s not just the rate I’m looking for, but also what I’m getting within the terms of the agreement.

For whatever it’s worth, I’ve been with Surnet (contacts details in post #226 above) for about 5 years and they are excellent - I think my current policy is with Aviva.

Last year, the only insurer willing to insure me on an M1 with a M1X certificate was Echelon through Riders Plus. So I went with them.

This year, I did shop around as the renewal is due on the 25th of this month. Both through brokers (Reached out on the forum) as well as direct. The best quote I got, for the same comprehensive policy, was from TD, and the reduction was quite substantial ($400) which is surprising because last year they wouldn't even entertain my request.

Last edited:

1st year riders are the highest risk. As I recall you’re also older? Surprisingly (unsurprisingly) the highest #of claims made by new riders are not the young’ensLast year, the only insurer willing to insure me on an M1 with a M1X certificate was Echelon through Riders Plus. So I went with them.

This year, I did shop around as the renewal is due on the 25th of this month. Both through brokers (Reached out on the forum) as well as direct. The best quote I got, for the same comprehensive policy, was from TD, and the reduction was quite substantial ($400) which is surprising because last year they wouldn't even entertain my request.

kurtrules

Well-known member

1st year riders are the highest risk. As I recall you’re also older? Surprisingly (unsurprisingly) the highest #of claims made by new riders are not the young’ens

Well, by older if you mean not in my teens anymore then yes

I am 37.

Younger then I thought!Well, by older if you mean not in my teens anymore then yes

I am 37.