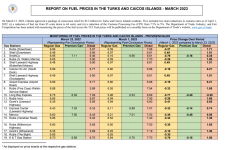

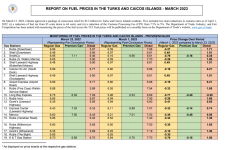

Here's the data I found for T&C. Your math is off ToSlow.

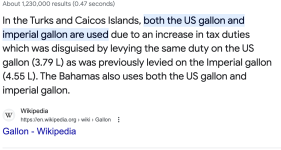

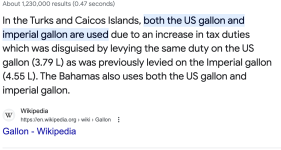

Looks like some shenanigans were used as well at one point....

But from what I can see now, they're gone to pure US gallons, so 3.8L/gallon. And the gas prices are in USD.

So, using what looks to be about $7.25/gallon USD average for premium, that comes out to $2.62/L Canadian for premium. Premium right now in my neck of the woods is showing about $1.60/L here.

So, yeah, it's still over $1/L (CAD) more expensive there than here.

Regular at around $6.60/gal there, the math works out to $2.39/L, also basically $1/L (Cad) more expensive than here.

Looks like some shenanigans were used as well at one point....

But from what I can see now, they're gone to pure US gallons, so 3.8L/gallon. And the gas prices are in USD.

So, using what looks to be about $7.25/gallon USD average for premium, that comes out to $2.62/L Canadian for premium. Premium right now in my neck of the woods is showing about $1.60/L here.

So, yeah, it's still over $1/L (CAD) more expensive there than here.

Regular at around $6.60/gal there, the math works out to $2.39/L, also basically $1/L (Cad) more expensive than here.