Let's clear some of this out of the other discussion.

Go for it . . .

Go for it . . .

Funny, I never cared about the paint in my life.I'd think 2-3 months staring at the same ugly kitchen, awful paint color or crappy carpet in a rental , knowing you cant change it even if you wanted to, esshh....

Aren't you getting married soon? Your wife may have a different viewpoint on this. I personally don't care for changing colours of rooms...my wife has different viewpoints. I think 2x in our marriage I came home to a different coloured house. Works for me as I just got out of painting the apartment we lived in!Funny, I never cared about the paint in my life.

Something with utility I could understand, like cabinets.

But colour? Lol, far more important things to do then dwell on how sombre that blue is making me feel.

Interesting how we're all wired a bit differently.

Edit: if this is something you actually care about, why not find a place that suits your wants or try to negotiate with the landlord?

Post poned till next summer but yes.Aren't you getting married soon? Your wife may have a different viewpoint on this. I personally don't care for changing colours of rooms...my wife has different viewpoints. I think 2x in our marriage I came home to a different coloured house. Works for me as I just got out of painting the apartment we lived in!

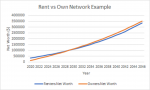

Cool. Why does the renters net worth appear to be linear? Over a 25 year timeframe, I would expect to see the exponential curve.Real life numbers for a house across the street as I know a lot of the numbers and/or can closely estimate based on my costs for my similar house.

Fully renovated house was being rented for 4K a month.

New owners paid $1.7M for it and moved in.

So it is based on renting at 4K verses buying at $1.7M.

Calculation includes (Toronto):

20% down

Land transfer taxes at purchase (Toronto).

Closing costs (buy and sell).

Real estate fees at selling.

Property tax indexed to inflation.

Maint costs indexed to inflation.

Rent index to inflation.

Insurance indexed to inflation (renter and home owner)

Investing the down payment and the monthly delta.

Property appreciation.

3% mortgage rate over the duration.

etc. etc.....

Everything includes the TVofM where appropriate.

Cashing out at each point (selling all assets), net assets.

As real world as it can be....

The renter in this example is further ahead until 2029 (9 years)--crossover then--after that that point the home owner is further ahead. So if your plan is to own the same place longer than nine years you are in the black in this example, if you sell before then the owner loses and renter wins.

View attachment 42864

Numbers based on Toronto, expect some minor shifts for different areas as 905 has lower land transfer by higher property tax.

Selling could be for any reason, lifestyle change, job move, job loss, divorce, death, upgrade, downgrade...does not matter. Nine years is or is not a long time.

Of course totally ignored is the monetary value of the perceived lifestyle and stability advantages and disadvantages for both cases.

How can one sway these numbers for owners, well you can buy a house that needs updating and repair and do the work yourself. Sweat equity. I still say this is the COVID-19 real estate opportunity as flippers move to the sidelines.

Or you can rent out the basement, grow op, whatever...

My parents have had a few bears in their backyard and a cougar up the road. I'm ok without animals that may eat my children being that close to the house.for real If there isnt a chance of being eaten by a bear in my neighborhood, I dont want to live there.

Can't get devoured if they sit on a ps4 or iPad all day? ?My parents have had a few bears in their backyard and a cougar up the road. I'm ok without animals that may eat my children being that close to the house.

Cool. Why does the renters net worth appear to be linear? Over a 25 year timeframe, I would expect to see the exponential curve.

Woah, that's better. The renter just found 200K. What was your expected rate of return on the renters investments?Solid Catch!!!!!, I was not properly compounding the the renters investments (formula error, missing an anchor on one of the cells). I fixed the chart in the original message... Does not impact the crossover year as the error was smaller in the early years (just happens later in the year)--such as how compounding works (but the overall advantage for the owner is dramatically lower!).

Nice chart. How are you accounting for the paying down of the house, with the yearly assumed % increase in the home value (even if it's small)? Or are you assuming a $1m home is a $1m home in X years with just a lower debt left due to paying it down?Solid Catch!!!!!, I was not properly compounding the the renters investments (formula error, missing an anchor on one of the cells). I fixed the chart in the original message... Does not impact the crossover year as the error was smaller in the early years (just happens later in the year)--such as how compounding works (but the overall advantage for the owner is dramatically lower!).

I think many people that were happy living in a tiny condo as they used the city as their living room, dining room and kitchen will be re-evaluating and looking for more private space in case another lockdown occurs. As people don't have unlimited money, this could push some current condo owners to become renters to get more space for the same monthly cost (assuming they "need" to stay downtown). Alternatively, some may head out to the burbs to achieve the same thing. I'm not sure whether the move to the burbs will alter the rent/buy demographics as I suspect there are a lot more houses for sale than for rent and obviously commuting cost spikes if you are still working downtown.

Woah, that's better. The renter just found 200K. What was your expected rate of return on the renters investments?

Thanks. I would hope the investor could beat 5% (by a lot) but its not an unreasonable choice.5%, nothing too exciting. Plus of course the monthly savings, also compounded at 5% (assumes they invest it).

****

In the end there are a lot of variables but due to the cost of the initial real estate transaction (land transfer tax, closing costs) the renter will have a head start on net worth at the beginning... then there are real estate fees and closing costs at the end. At some point it will usually crossover in favour of the owner, when will depend on the numbers.

It all assumes a very disciplined renter that invests every penny of savings (the cost delta between renting and owning). There is no argument that is a very rare occurrence.... and forced savings is an advantage (and potential lifestyle disadvantage) to the owner.

And then another COVID-19 comes and wipes out 30% of the gains. Hopefully it's a V shaped recovery as some have stated, but could be a much more painful and extended recovery.Thanks. I would hope the investor could beat 5% (by a lot) but its not an unreasonable choice.

That's ok. I am aiming for 10 to 20% average market returns.And then another COVID-19 comes and wipes out 30% of the gains. Hopefully it's a V shaped recovery as some have stated, but could be a much more painful and extended recovery.