Annual update. I finally input everything into a sheet that tracks cumulative performance across all accounts and extends back to quite a while. Not quite all the way back to when I started self-directed investing as I restarted tracking when I met my wife and the brokerage I used before no longer exists. That sheet also allows me to calculate metrics to help me see if I am taking insane risk. Drawdowns that are painful in the moment become immaterial when you zoom out.

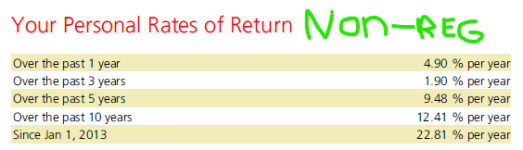

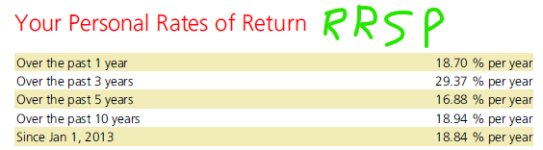

Average over the last 17 years: Return 21%, SD:17%, Sharpe:1.2, Sortino:3.3, Calmar:1.8. Max draw down was 20% (looking at monthly data, spreadsheet doesn't track daily data). Better than I expected as I haven't calculated them until now. S&P500 beat me three out of 17 years. In those years, it beat me by 6% on average. On the years I beat S&P, I was ahead by 11% on average.

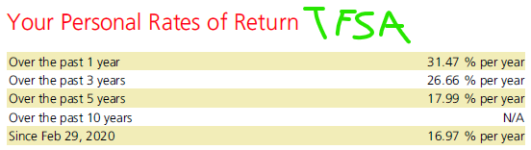

I made maybe a dozen trades in 2025. Reducing some concentrated positions in favor of diversity. Bought some gold and silver which I've never had before (~5% of investable assets). I turned off some drip's to extract more to pay down investment loan so more capital is available when the inevitable correction happens (at that point metal will be liquidated to buy equities, I don't want it long term). I was waiting for 20% drop in April and it didn't get there. Lesson learned, average in on the way down. It's scary with borrowed money.

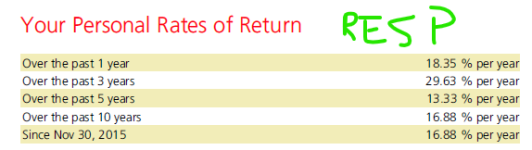

I bought gold in october and sold it in december after a 10% bump. Moved money out of TFSA as imo, metals are playing with fire and I don't want to risk a big drop inside tfsa. Bought gold and silver at xmas. Sold 25% of silver and bought gold when silver was up 33% and another 25% when it was over 50% gain. That will shield me from a 66% drop in silver which is entirely possible. I'll let the rest ride and see what happens. Putting it in a taxable account will cost me some tax that would have been avoided in tfsa. Without the benefit of hindsight, there is no way to know the best path. Outside TFSA also avoids CRA issues as they refuse to detail what level of activity is allowable in a tfsa. High frequency trading is a clear fail, buy and hold is a clear pass. There is a giant gap between those two positions that is undefined. Would weekly or monthly trades get hammered? Nobody knows (including CRA).