TK4

Well-known member

I suppose timing isn't important but as the Christmas season draws near maybe we should all think about helping out those who are less fortunate.

There are hundreds of worthwhile charities, and over the years I've tried to research (and contribute) to the ones where the money goes to maximum benefit.

For many years I was directly involved in one particular event that raised over $375,000 towards Sick Kids Hospital Toys and Games Fund, alas it is no more.

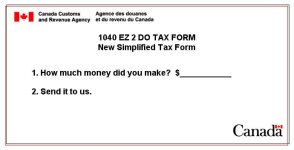

Pick one (or two or three) make a tax deductible donation - I don't need another pair of socks or an ugly sweater and the likelihood is that your family and friends don't either. Make the donation in their name if you like and spread the wealth and the joy.

What's the worst that can happen ???

There are hundreds of worthwhile charities, and over the years I've tried to research (and contribute) to the ones where the money goes to maximum benefit.

For many years I was directly involved in one particular event that raised over $375,000 towards Sick Kids Hospital Toys and Games Fund, alas it is no more.

Pick one (or two or three) make a tax deductible donation - I don't need another pair of socks or an ugly sweater and the likelihood is that your family and friends don't either. Make the donation in their name if you like and spread the wealth and the joy.

What's the worst that can happen ???