I haven't read the whole thread, so apologies if that was mentioned before, but I just signed up for the TD app thingie for my brand new Nissan Kicks and it quickly became apparent that it's easy to game the system.

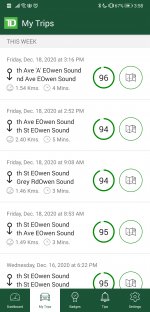

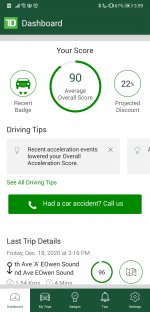

I invariably score high (90%+) on <5kms trips and mediocre (~75%) on long trips.

You want to do short trips. It seems like you can only lose points during a trip, so the strategy is to break up your drive in multiple parts. Stop at Timmies on the way to your final destination and what would've been one 80% trip becomes two 90% trips. The same 20 points were deducted but over two trips. lol

And as far as I can tell, your average score doesn't take distance into consideration. It's [sum of scores/number of trips].

Go figure.

I invariably score high (90%+) on <5kms trips and mediocre (~75%) on long trips.

You want to do short trips. It seems like you can only lose points during a trip, so the strategy is to break up your drive in multiple parts. Stop at Timmies on the way to your final destination and what would've been one 80% trip becomes two 90% trips. The same 20 points were deducted but over two trips. lol

And as far as I can tell, your average score doesn't take distance into consideration. It's [sum of scores/number of trips].

Go figure.