I disagree.

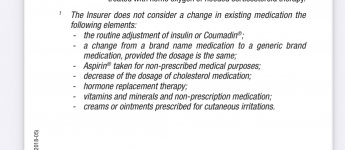

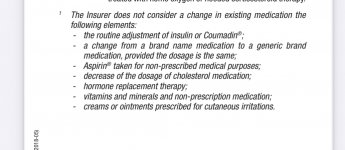

There is no reason why you would need to disclose your personal business (including modifications) to insurance companies because it is not their business and they will not be honest or act in good faith.

For an example. For some cars, the base model and the "sport" model have exactly the same specs. Meaning, they handle the same, go just as fast, same horse power, etc. Except that the sport models typically have better breaks and more warning systems such as rear cross or blind spot warning systems.

In theory, driving the sport model is actually safer and less likely to result in a collision, whereas, the sport model will be quiet considerably more expensive, simply because it says "sport." It is clear without a spec of doubt that insurance companies do not act in good faith, or have your best interest in mind, and they get away with a lot because insurance is mandatory. No one should ever be honest with insurance companies until such time that they are honest with us!

If we go by your opinion here; that they should not be accountable because of some paperwork. Then no one ever has had insurance. They WILL find a reason to deny a claim every time they want to. There will always be something silly in the paper work they can fall back on. That's why, as far as I am concerned, I would not voulanterilly tell them about my modifications, just to voulanterly give them more of my hard earned money, only for them to turn around and screw me over anyways!

I do not have to tell them if I want my windows tinted.... I do not have to tell them if I drive 10 km/h over the speed limit all the time. I do not have to tell them I changed my headlights or break lights to make the car look nicer. It's not their business how long my commute to work is. Not their business how much I drive every year. They definitely have to prove to me that my modification (be it tint, headlight) caused the accident.

At the end of the day, they did pay the kid.

globalnews.ca