They found out because they are extremely under regulated, banks were given loans to people they knew they couldn't afford, then they were packaging these bad loans and selling them as a bundle to other investment firms, this went on for years until the bubble pop and the system they knew was ****ed collapsed. This is not the same case, have you tried to get a loan for a house here in Canada?There's a country just a tad bit south of us that found out otherwise

|

|

|

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Condo harassing me

- Thread starter daught

- Start date

CMHC is a government-run institution, not a private insurance company.

The bank's loans are insured for 100% in case it all goes belly up. No wonder they'll give anyone with a pulse a mortgage, there is zero risk on their end

Oh, I knew it was government run but was hoping it stand on it's own two legs, not spill over like say, the education portion of property tax. We're living in a freakin commune.

They found out because they are extremely under regulated, banks were given loans to people they knew they couldn't afford, then they were packaging these bad loans and selling them as a bundle to other investment firms, this went on for years until the bubble pop and the system they knew was ****ed collapsed. This is not the same case, have you tried to get a loan for a house here in Canada?

Investment packages with best risk ratings by guess who? White collar crime pays.

They found out because they are extremely under regulated, banks were given loans to people they knew they couldn't afford, then they were packaging these bad loans and selling them as a bundle to other investment firms, this went on for years until the bubble pop and the system they knew was ****ed collapsed. This is not the same case, have you tried to get a loan for a house here in Canada?

What world do you live in?

In the states the majority of the loans were insured by private companies, here its covered by cmhc or our government, or to better explain it to you every single one of us.

You think the canadian banks give a **** how risky the loan is when giving out a mortgage to anyone in canada? Its all insured and there is zero risk on their end if its covered by cmhc.

Now go and try and get a business loan, thats a different story.

So many people in this country think we are somehow so much better off than the states but they have no idea. The best thing that could have happened to canada in 08 would have been a nice correction. But instead we avoided it and now the bubble just got bigger.

Someone mentioned a real estate correction in this thread. The scary thing about that is even if the correction results in a 20% price decrease, the prices are still a little out of my comfort zone for a house in the city. Supply and demand...

If it drops 20% i think it will go a lot further. The same people who jumped on board thinking real estate was the greatest investment in the world will be the first ones to bail once they think they'll lose more money. When panic hits there's no predicting where it ends...

If it drops 20% i think it will go a lot further. The same people who jumped on board thinking real estate was the greatest investment in the world will be the first ones to bail once they think they'll lose more money. When panic hits there's no predicting where it ends...

I would agree with that in lower tier neighbourhoods, as those are always the first and most to feel recessions. I do think that for the desired neighbourhoods, the speculators won't let the prices drop that low. someone will scoop the properties up.

I would agree with that in lower tier neighbourhoods, as those are always the first and most to feel recessions. I do think that for the desired neighbourhoods, the speculators won't let the prices drop that low. someone will scoop the properties up.

Not if they believe its tanking

I have family and friends in the states and the same logic/arguments were common before everything went south there as well.

One person i know purchased a 300k home, it was eventually sold by the bank for 80k. Another one purchased a condo for almost 200k. Held on to it through it all, and they have the condo to this day. Its now worth 80K, after all these years of holding onto it, paying interest, taxes etc...

Listen men, It is ok if you fell that buying is not the best option for you, but there is no need to **** in everyone else that decided their best option is to buy.

I wasn't comparing the States with Canada, you did so I was just providing some context to the very vague and misleading comment you made implying that what happened in the US will happen here, unless you see the future there is no way for you to know.

Most people I KNOW have made smart decisions with their money in regards to mortgages, the ones that normally don't make good decisions can not afford to purchase anyways because they suck with money and are stuck renting and being told what they can or can not park on their parking spots

Take it easy, don't want to buy? don't.

By the way, when I went to get a loan to buy the current house, they look at our combined death, our salaries and our expenses and credit ratings and set a maximum we could borrow according to those figures, guess what, we borrowed way less (as I said we sold a property and used the money to buy this one) but even if we had borrowed the max amount set by the bank, we would have comfortably been able to pay it, so something right they must be doing.

Also, we had to put down 20% - this on it's own will push away anyone to 'just go and buy a house they can't afford'. I know it is 5% for first time buyers but those people are not the ones making the huge purchases, new owners are regularly buying a small condo or a really small bungalow.

I wasn't comparing the States with Canada, you did so I was just providing some context to the very vague and misleading comment you made implying that what happened in the US will happen here, unless you see the future there is no way for you to know.

Most people I KNOW have made smart decisions with their money in regards to mortgages, the ones that normally don't make good decisions can not afford to purchase anyways because they suck with money and are stuck renting and being told what they can or can not park on their parking spots

Take it easy, don't want to buy? don't.

What world do you live in?

In the states the majority of the loans were insured by private companies, here its covered by cmhc or our government, or to better explain it to you every single one of us.

You think the canadian banks give a **** how risky the loan is when giving out a mortgage to anyone in canada? Its all insured and there is zero risk on their end if its covered by cmhc.

Now go and try and get a business loan, thats a different story.

By the way, when I went to get a loan to buy the current house, they look at our combined death, our salaries and our expenses and credit ratings and set a maximum we could borrow according to those figures, guess what, we borrowed way less (as I said we sold a property and used the money to buy this one) but even if we had borrowed the max amount set by the bank, we would have comfortably been able to pay it, so something right they must be doing.

Also, we had to put down 20% - this on it's own will push away anyone to 'just go and buy a house they can't afford'. I know it is 5% for first time buyers but those people are not the ones making the huge purchases, new owners are regularly buying a small condo or a really small bungalow.

Last edited:

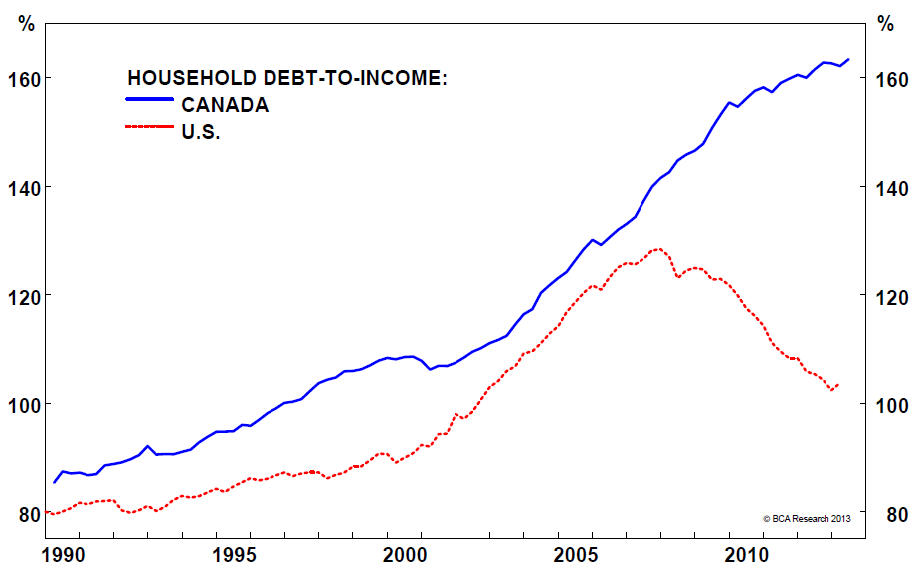

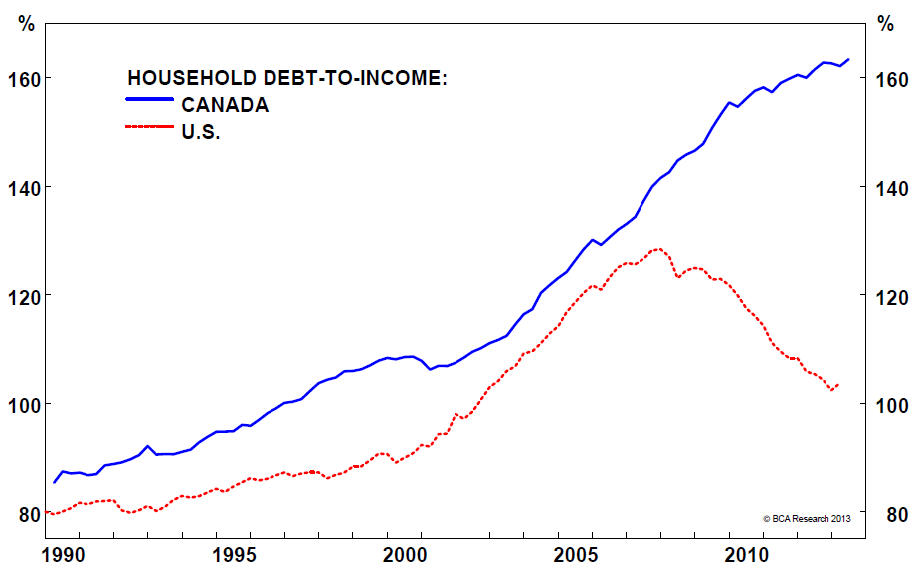

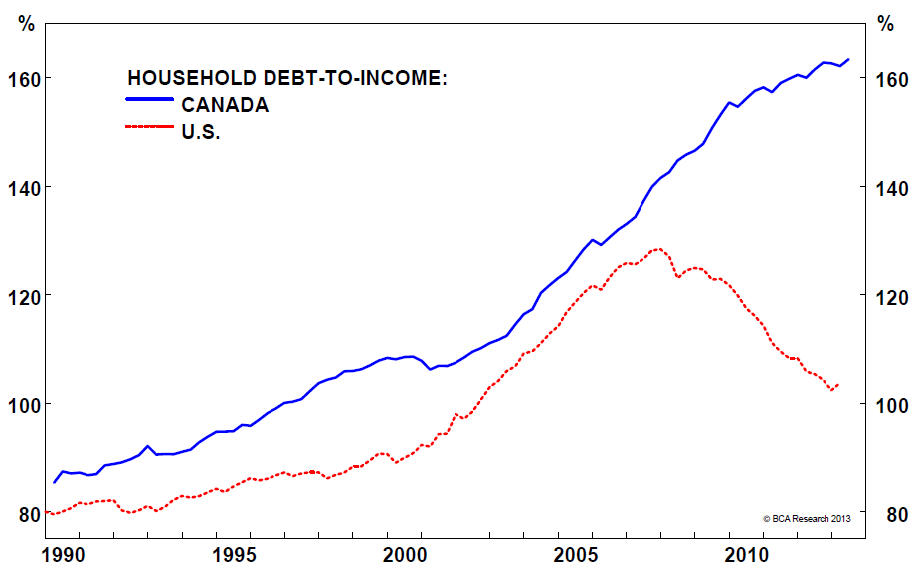

Would you like to be more specific of what is it that we have no idea about? because that graph does nothing to make your point. You also have to put that graph beside economic growth and you will see a correlation justifying the increase in house prices.

So many people in this country think we are somehow so much better off than the states but they have no idea. The best thing that could have happened to canada in 08 would have been a nice correction. But instead we avoided it and now the bubble just got bigger.

You cant compare US to Canada in the underwater market, they had no fault mortgages, if you paid $300 and now its worth $100, you could walk on the mortgage, throw the keys in the front door and NOT be chased for outstanding balance. Then someone would write you a mortgage and you could buy the house down the block for $100. Our system was not like that.

Worse the bank would encourage people that were mortgage free to "use home equity" to buy a 150k motorhome, since the interest on a mortgage in US is tax deductible, now you owe $145 on a motorhome and your house you levered is worth less than the combined debt. Cooked. We had a different system.

Worse the bank would encourage people that were mortgage free to "use home equity" to buy a 150k motorhome, since the interest on a mortgage in US is tax deductible, now you owe $145 on a motorhome and your house you levered is worth less than the combined debt. Cooked. We had a different system.

Listen men, It is ok if you fell that buying is not the best option for you, but there is no need to **** in everyone else that decided their best option is to buy.

I wasn't comparing the States with Canada, you did so I was just providing some context to the very vague and misleading comment you made implying that what happened in the US will happen here, unless you see the future there is no way for you to know.

Most people I KNOW have made smart decisions with their money in regards to mortgages, the ones that normally don't make good decisions can not afford to purchase anyways because they suck with money and are stuck renting and being told what they can or can not park on their parking spots

Take it easy, don't want to buy? don't.

Don't get offended MAN!

You're so convinced that what happened to the states won't happen here and im simply trying to show you that we're in no better condition than the states.

"banks were given loans to people they knew they couldn't afford" Our banks are doing the exact same thing at the expense of the taxpayers. They keep the profit we take the risk.

The bubble just gets bigger, can you honestly tell me that a 70 year old moldy bungalow in the gta with no garage is worth 700-900k?

Look at the chart i posted and the level of debt we as canadians are in. Every year its going up, we're not getting richer, we're just taking on more debt. How long do you think this can last before something goes wrong?

You cant compare US to Canada in the underwater market, they had no fault mortgages, if you paid $300 and now its worth $100, you could walk on the mortgage, throw the keys in the front door and NOT be chased for outstanding balance. Then someone would write you a mortgage and you could buy the house down the block for $100. Our system was not like that.

Worse the bank would encourage people that were mortgage free to "use home equity" to buy a 150k motorhome, since the interest on a mortgage in US is tax deductible, now you owe $145 on a motorhome and your house you levered is worth less than the combined debt. Cooked. We had a different system.

What you talkin bout willis? No fault? You mean no recourse?

Almost every time I read one of your contributions I'm overcome with crushing feelings of envy and self loathing. Is that by design or just a coincidental by-product?

Id love to see a correction, I have no mortgages and would buy a townhouse in Bronte on the lake in a heartbeat if they were under $800k. Landlords love corrections, it puts those smug 5% down/5k cashback 25yr mortgage folks back on the waiting list for a rental when they implode.

The US mortgage fiasco was awesome for most Canadians, houses in FLA and AZ were at 20yrs ago price levels, great time to get a vacation house, just don't try and get a US mortgage if your CDN or a CDN mortgage on a US property , that's a level of pain.

Not meaning to gloat, I have been extremely lucky and blessed with good mentoring and quite by accident surrounded myself with successful people that through osmosis showed me things that have mostly worked out. There is good debt and bad debt and knowing the difference is everything, that and just dumb luck.

I told my kids, being friends with people that have cottages and southern vacation homes and want to go to university is no harder than being friends with joey bumfester that wants to ride his BMX bike and smoke weed, and long term one plan may be better than the other.

being friends with people that have cottages and southern vacation homes and want to go to university is no harder than being friends with joey bumfester that wants to ride his BMX bike and smoke weed, and long term one plan may be better than the other.

I have often found those who have cottages and vacations homes are also the kids who want to bmx and smoke weed in university. First generation works hard to create wealth, 2nd generation carries it on and 3rd generation spends it all.

Not offended at all, I am having a salad as I type. You are making some assumptions in those comments.

Houses are worth what people will pay for them, if people are paying 700 - 900 for a bungalow, then that is the price. With how crazy my commute is I can understand why people prefer to pay high for something small and increase their quality of life by not having to commute.

Same reason why i just downsized, went close to the city and the result is higher price and less space but a lot less driving as an example.

I was watching property brothers last night and a couple bought a piece of crap little house in the St Clair and Yonge area, 1.1 million for something the size of my garage, by the time they were done they spent 1.25 M. guess what, they can turn it around tomorrow and make money out of it. Do I think is crazy, yes but hey, people are paying it.

Houses are worth what people will pay for them, if people are paying 700 - 900 for a bungalow, then that is the price. With how crazy my commute is I can understand why people prefer to pay high for something small and increase their quality of life by not having to commute.

Same reason why i just downsized, went close to the city and the result is higher price and less space but a lot less driving as an example.

Don't get offended MAN!

You're so convinced that what happened to the states won't happen here and im simply trying to show you that we're in no better condition than the states.

"banks were given loans to people they knew they couldn't afford" Our banks are doing the exact same thing at the expense of the taxpayers. They keep the profit we take the risk.

The bubble just gets bigger, can you honestly tell me that a 70 year old moldy bungalow in the gta with no garage is worth 700-900k?

Look at the chart i posted and the level of debt we as canadians are in. Every year its going up, we're not getting richer, we're just taking on more debt. How long do you think this can last before something goes wrong?

I was watching property brothers last night and a couple bought a piece of crap little house in the St Clair and Yonge area, 1.1 million for something the size of my garage, by the time they were done they spent 1.25 M. guess what, they can turn it around tomorrow and make money out of it. Do I think is crazy, yes but hey, people are paying it.

Last edited:

Not offended at all, I am having a salad as I type. You are making some assumptions in those comments.

Houses are worth what people will pay for them, if people are paying 700 - 900 for a bungalow, then that is the price. With how crazy my commute is I can understand why people prefer to pay high for something small and increase their quality of life by not having to commute.

Same reason why i just downsized, went close to the city and the result is higher price and less space but a lot less driving as an example.

I was watching property brothers last night and a couple bought a piece of crap little house in the St Clair and Yonge area, 1.1 million for something the size of my garage, by the time they were done they spent 1.25 M. guess what, they can turn it around tomorrow and make money out of it. Do I think is crazy, yes but hey, people are paying it.

I think i saw the same episode lol

Get rid of cmhc and lets see if the banks still give them these loans...

Banks are profiting off people's stupidity, and the government is enabling it.

Common sense has been long lost here...

I think the 3rd generation is well connected and educated and will make even more money!I have often found those who have cottages and vacations homes are also the kids who want to bmx and smoke weed in university. First generation works hard to create wealth, 2nd generation carries it on and 3rd generation spends it all.

IMO

Paul, you seem to be the angry one, did you not get approved for a loan for a house?

I think the 3rd generation is well connected and educated and will make even more money!

IMO

Paul, you seem to be the angry one, did you not get approved for a loan for a house?

All the education in the world wont help you if there are no jobs around. Everything is going overseas...

Im not angry at all, no issues with getting a loan on my end.

|

|

|

|

|