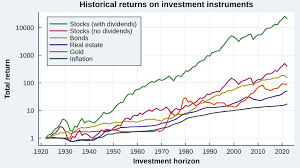

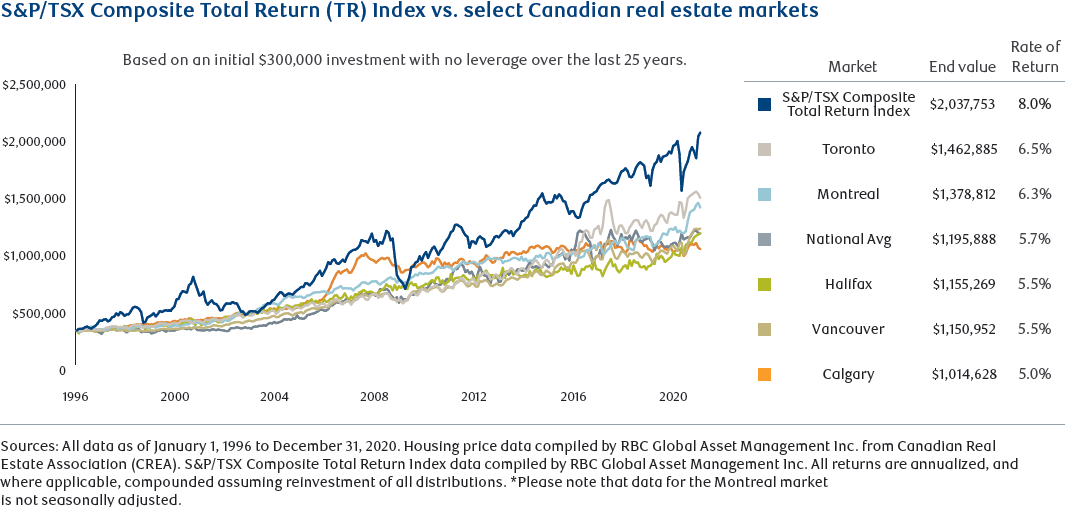

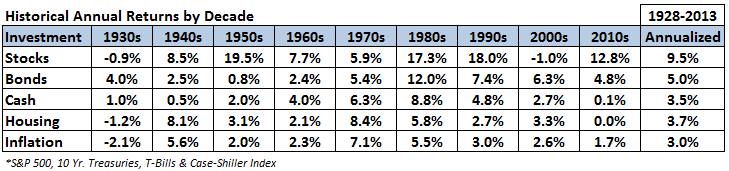

A graph of wages vs house prices / rent in the last 10 years would be more telling.I can't find the better version of this graph but this is close enough. US real estate averages about 5.3% return over the pas 30 years or so (higher than I expected honestly as US house prices for a typical house don't seem to change much). It looks like ROR on real estate in canada is slightly higher (up to 6.5% in Toronto). S&P 500 averages over 10% yearly over 30 years. The big difference with real estate returns is almost everybody has highly leveraged real estate investments and zero leverage on market investments.

Now, your mom's place shows that the average ROR is not applicable to every dwelling. Her house averaged 10% ROR. Add leverage to that and net worth changes quickly.

Buy your grandkids $1000 in S&P500 when they are born and that is about 500K when they retire. If you can afford to put $6000 in at birth, you have pretty much done their retirement savings for them at that will be about 3M at 65.

Superimpose those over the world instability situation and emigration / immigration patterns and it gets worse.

Throw in politicians with three and four year mind sets and the smell gets so bad that decent people don't want to get involved.

A lot of things on this planet form exponential curves that get really nasty as the curves go ballistic. At some point things go critical and the lifeboat can't handle the load. We're close to or have passed that point on many fronts.