Re: WTH is OPCF44 "Family Protection Endorsement"?

OKAY! I think I figured it all out finally.

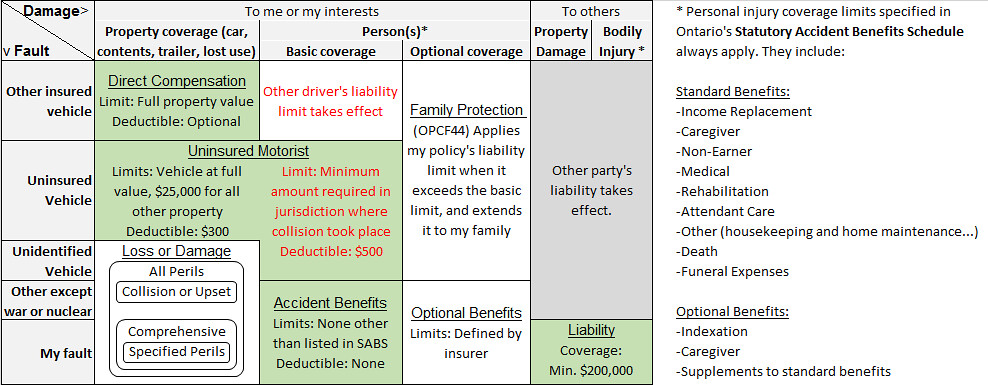

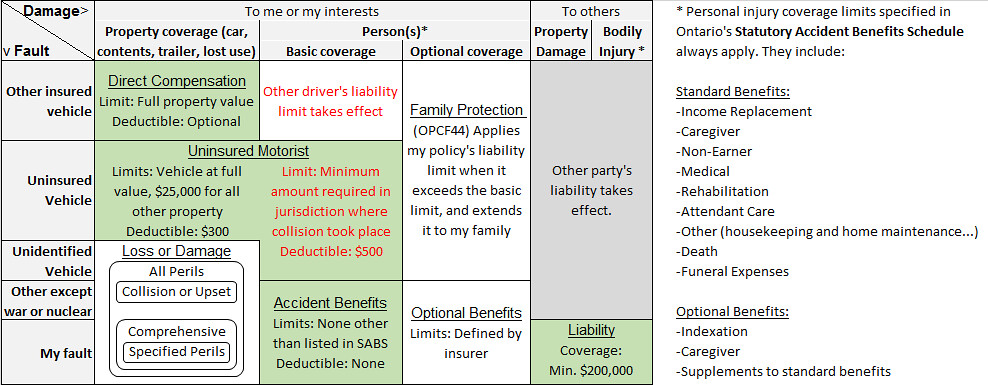

I read up on my insurance policy docs and legislation online, and then got confirmation on some questions I was unsure about over a long chat with my insurer. After 26 years having auto insurance of some kind, I think I get it now. I put everything together in a table to make sure I had it clear in my head as I went along. Maybe this can help others too.

Now I understand what all that insurance lingo means, and where it applies in case of a claim. Terms like 'Direct Comp', or 'Comprehensive Coverage', or 'Medical Benefits' make more sense now. Mandatory coverage in Ontario are the areas shown in green.

The big lesson for me here is that fault determination absolutely matters! It changes everything (as the left column indicates). "No fault insurance" is just an inside baseball term that has absolutely no significance to end users at all. It's actually pretty misleading. No wonder I couldn't get any easy answer from anyone too. This stuff is pretty convoluted compared to the way I always imagined it to work.

More to the point of this thread though, I now understand that the coverage for personal injury to myself or my occupants in the event of a collision that is the fault of an under-insured motorist (the red text in the chart) can be very low. It's not that the coverage is completely missing, just that there's a fair risk that my (or my passenger's) injuries could exceed the at-fault driver's ability to cover them. Then I'd have to try and recover the extra costs from them directly through the courts, which may be money they don't have. That's where OPCF44 comes in. It tops up any meager coverage that the at-fault driver may have to the same level as my own liability coverage, and makes it my insurance company's problem to try and recover the money from them.

So I went and added back OPCF44 and increased my liability to $2 million. Mostly that was to add coverage to myself or my passengers if we were injured by an under-insured driver, but also having read some of the Benefits Schedule, there are a few instances where a particular type of injury automatically entitles the person to a nice round $1 million. That means if I'm responsible for someone's harm, any little accident benefit they need beyond $1 million would come straight out of my pocket. Not saying the type of injury that needs a $1 million benefit is a likely scenario, but the extra $1 million coverage is super cheap so it seems very much worth it.

OKAY! I think I figured it all out finally.

I read up on my insurance policy docs and legislation online, and then got confirmation on some questions I was unsure about over a long chat with my insurer. After 26 years having auto insurance of some kind, I think I get it now. I put everything together in a table to make sure I had it clear in my head as I went along. Maybe this can help others too.

Now I understand what all that insurance lingo means, and where it applies in case of a claim. Terms like 'Direct Comp', or 'Comprehensive Coverage', or 'Medical Benefits' make more sense now. Mandatory coverage in Ontario are the areas shown in green.

The big lesson for me here is that fault determination absolutely matters! It changes everything (as the left column indicates). "No fault insurance" is just an inside baseball term that has absolutely no significance to end users at all. It's actually pretty misleading. No wonder I couldn't get any easy answer from anyone too. This stuff is pretty convoluted compared to the way I always imagined it to work.

More to the point of this thread though, I now understand that the coverage for personal injury to myself or my occupants in the event of a collision that is the fault of an under-insured motorist (the red text in the chart) can be very low. It's not that the coverage is completely missing, just that there's a fair risk that my (or my passenger's) injuries could exceed the at-fault driver's ability to cover them. Then I'd have to try and recover the extra costs from them directly through the courts, which may be money they don't have. That's where OPCF44 comes in. It tops up any meager coverage that the at-fault driver may have to the same level as my own liability coverage, and makes it my insurance company's problem to try and recover the money from them.

So I went and added back OPCF44 and increased my liability to $2 million. Mostly that was to add coverage to myself or my passengers if we were injured by an under-insured driver, but also having read some of the Benefits Schedule, there are a few instances where a particular type of injury automatically entitles the person to a nice round $1 million. That means if I'm responsible for someone's harm, any little accident benefit they need beyond $1 million would come straight out of my pocket. Not saying the type of injury that needs a $1 million benefit is a likely scenario, but the extra $1 million coverage is super cheap so it seems very much worth it.

Last edited: